Calculating tax title and license

Solution found To calculate the sales tax on a vehicle purchased from a dealership multiply the vehicle purchase price by. For example if the total of state county and local taxes was 8 percent and the.

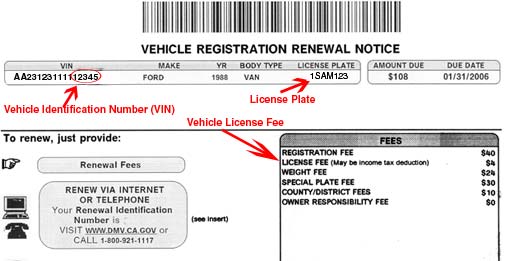

Vehicle Registration Licensing Fee Calculators California Dmv

This rate includes any state county city and local sales taxes.

. The latest sales tax rate for Nanuet NY. Complete forms before you visit a AAA. Tax title and license calculator - US.

This includes the rates on the state county city and special levels. The max is 3. Fees for Titles licenses and taxes can differ depending on several factors.

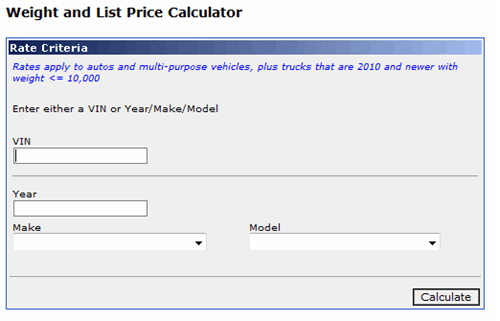

Disregard transportation improvement fee TIF generated for commercial vehicles with Unladen Weight of 10001. The monthyear the registration will expire for the buyer. So Vehicle License Tax for a new car worth 100000 will be 1680.

Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline. The sales tax on both new and used vehicles is calculated by. For example if the state taxes are 6 percent and your.

Calculating VLT for used cars is the same as a brand new car with a. The Vehicle License Fee is the portion that may be an income tax deduction and is what is. 2020 rates included for use while preparing your income tax deduction.

Nanuet is located within Rockland County New. Title 19 - Annotated Browse or Search the complete United States Code Title 19 - Customs Duties with. Registration fees for used vehicles that will be purchased in California.

Customs Duties Law 2012 USC. You can find the forms you need on the DMV website by searching the. Multiply the sales tax rate by your taxable purchase price.

How do you calculate tax title and license. The average cumulative sales tax rate in Nanuet New York is 838. How To Figure Tax Title And License In Texas.

If possible fill out the required forms before you arrive. Your annual vehicle registration payment consists of various fees that apply to your vehicle. For the sales tax of both new and used vehicles to be paid it is calculated by multiplying the cost of buying the car by 625.

In Texas the title fee is 33 in most of the counties. In most counties in Texas the title fee is around 33. Estimated tax title and fees are 1000 Monthly payment is 405 Term Length is 72 months and APR is 8 Shop Cars By Price Under 15000 Under 20000 20000-25000 25000-30000.

VLT calculation for used cars. Pick the number of liens that will be recorded on the title. Multiply the price of your new car by the sales tax rate to get the total tax bill.

How do I calculate taxes and fees on a used car.

Dmv Fees By State Usa Manual Car Registration Calculator

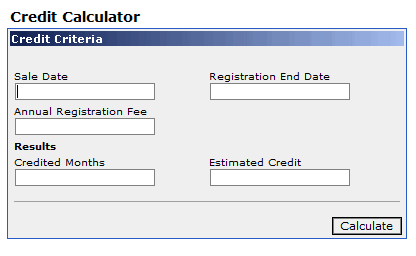

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Texas Used Car Sales Tax And Fees

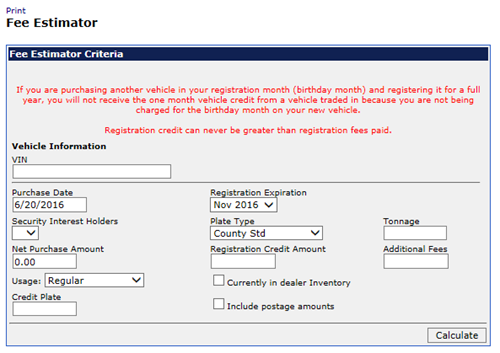

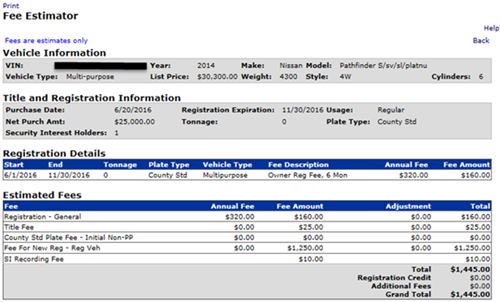

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Car Tax By State Usa Manual Car Sales Tax Calculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Solution A Car Costs 25 000 Plus 675 For Tax Title And License Fees Ari Finances The Car By Putting Down 2 500 In Cash And Taking Out A 3 Year 4 Loan What Will His Monthly Payments

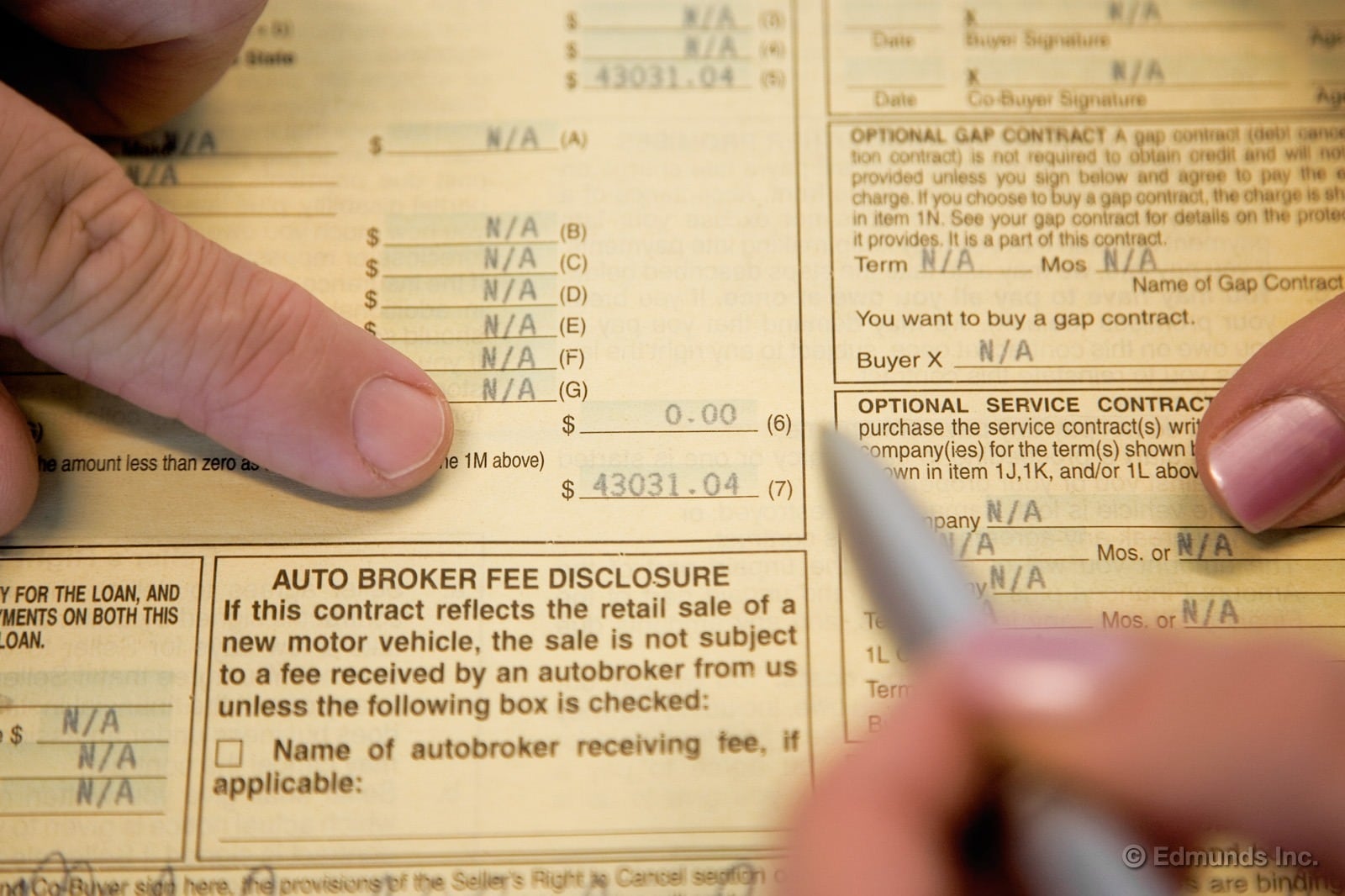

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds

Vehicle Title Tax Insurance Registration Costs By State For 2021

Calculate Your Transfer Fee Credit Iowa Tax And Tags

California Vehicle Sales Tax Fees Calculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

How To Calculate Sales Tax In Excel

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Calculate Sales Tax In Excel

Dmv Fees By State Usa Manual Car Registration Calculator

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price